Since the late 1970s, when Deng Xiaoping opened the path of reform and the “socialist market economy,” China has undergone a transformation unparalleled in human history. From a largely agrarian and isolated nation, it has evolved into the world’s second-largest economy, the factory of the globe, and an increasingly confident geopolitical actor. Its policy rests on two interdependent pillars: national security (国家安全) and economic security (经济安全). Together, they form the backbone of what Chinese officials call “high-quality development”, a term that blends growth with state control, innovation, and ideological discipline.

Yet China’s rise has also created powerful myths. Some portray the country as an unstoppable superpower destined to overtake the United States; others see a giant stumbling under its own weight, with a shrinking population, ballooning debt, and growing isolation. The truth, as always with China, lies somewhere in between.

Myth One: China is purely capitalist[Text Wrapping Break]To outside observers, the glittering skyscrapers of Shanghai, the global presence of Huawei, or the digital dominance of Alibaba and Tencent suggest that China has fully embraced capitalism. In reality, despite the prominence of private enterprise, the state remains the commanding force. The Communist Party maintains tight control over energy, finance, telecommunications, and strategic technology sectors. Even successful entrepreneurs understand that prosperity depends on political loyalty. The economy is, at its core, a hybrid system, a marriage of market dynamism and Leninist discipline, or as Beijing prefers to call it, “socialism with Chinese characteristics” or “hybrid capitalism”.

Myth Two: China’s economy is collapsing[Text Wrapping Break]Recent headlines often emphasize decline: the property crisis, local government debt, and demographic ageing. While these are serious challenges, they do not spell collapse. Instead, China is undergoing a transition — from the hypergrowth of the reform era to a phase of slower but more sustainable development. The state retains powerful levers to steer the economy, from monetary tools to direct industrial planning. Unlike Western economies, China’s command capacity enables it to cushion shocks and redirect resources toward strategic priorities such as green energy, semiconductors, and electric vehicles.

A walk through the markets of Chongqing offers a different kind of insight. There, amid the smell of hotpot and the hum of high-speed trains, one finds an economy almost without inflation and without cash. Unlike Europe or the United States, where rising prices fuel anxiety, China’s inflation remains subdued because it produces nearly everything it consumes. Everyday life is almost entirely digital. From cashier-free supermarkets to robot waiters, automation is ubiquitous. Even in open-air markets, payments are made via QR code. The “cashless” ecosystem reveals how deeply technology has been woven into Chinese society, creating what some economists now call “cloud capital”, a fusion of data, consumption, and state oversight that defines modern China.

Can this model be copied?

Many developing nations dream of replicating China’s success. Still, few can match its unique blend of factors: the vast scale of its domestic market, the efficiency of centralized decision-making, and a culture that prizes long-term stability over short-term profit. The Chinese model cannot be exported wholesale, though elements, particularly its focus on infrastructure and industrial upgrading, inspire initiatives from Central Asia to Africa.

In Beijing, the contrast between prosperity and inequality becomes striking. Urban–rural disparities remain wide, and millions of migrant workers live on the margins of modernity. President Xi Jinping’s campaign for “common prosperity” seeks to rebalance this uneven development, aiming to redistribute opportunity while maintaining political control. The implementation, however, is complex: efforts to regulate tech giants and curb speculative real estate have curbed excesses, but they have also chilled private investment. In China, economics and politics are inseparable; the Party’s legitimacy depends on delivering growth and stability.

To understand China’s economy, one must see it as a living organism full of contradictions, yet marked by extraordinary resilience. It is neither a “miracle without cracks” nor a “giant with feet of clay.” It is a constantly adapting system, capable of reinvention, and increasingly central to the fate of global trade and technology.

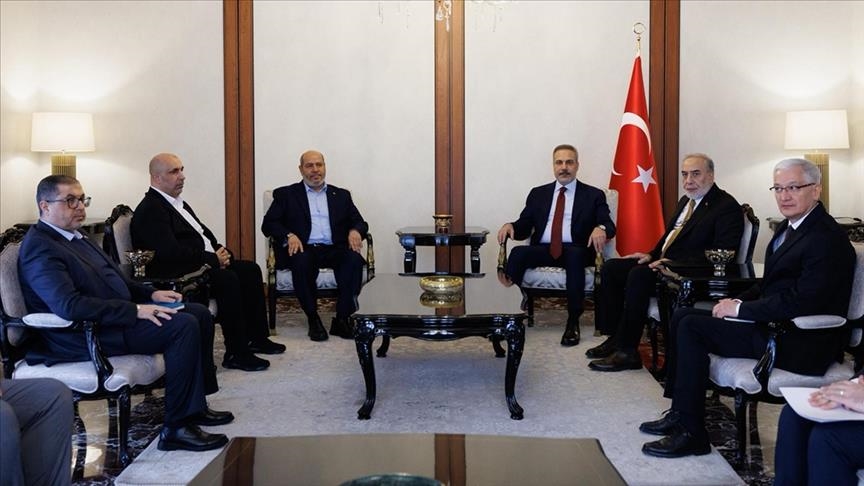

The Belt and Road Initiative (BRI) embodies this outward projection of power. Once focused on Eurasian railways and ports, it now extends to digital networks and green technology. Its “Middle Corridor” linking China with Türkiye and Greece through Central Asia underscores how Beijing’s economic reach now blends with geopolitics. For countries like Greece, whose port of Piraeus has become a major Chinese foothold in Europe, or Türkiye, a bridge between East and West, the challenge is to engage Beijing strategically without becoming dependent.

In the end, understanding China beyond the myths is not merely an academic exercise; it is a strategic necessity. The shifts underway from the rebalancing of its economy to the redefinition of its foreign policy will shape the world’s next economic cycle. As Greece and Türkiye position themselves along the new Silk Roads, their choices will reflect how smaller powers navigate a world no longer defined solely by Washington or Brussels, but increasingly by Beijing’s calibrated blend of ambition and control.

For anyone trying to read the future of the global economy, there may be no better observation deck than a high-speed train leaving Shanghai, where the rhythm of China’s transformation still hums at 350 kilometres an hour.