Against the backdrop of a rapidly fragmenting order in the Middle East, the Iran file is best understood not as a discrete crisis but as a multi-actor contest in which shifting balances on the Syrian and Iraqi theatres, great-power and middle-power signalling, and domestic political vulnerabilities interact in real time. In a region where every front is bleeding into the next, any scenario “about Iran” is never only about Iran. It reverberates across the Levant, the Gulf, the energy market, migration routes, and—crucially for Turkey—the domestic Kurdish question and the fragile logic of de-escalation at home. What has changed in recent days is not simply the temperature of regional rivalries, but the balance of leverage: Syria’s map is being redrawn at speed, the Syrian Democratic Forces’ (SDF) hand has visibly weakened, and Washington’s rhetoric toward its former Kurdish partners has notably cooled. That shift matters because it alters the strategic environment in which Tehran calculates risk—and in which Ankara tries to keep the region from tipping into a wider war.

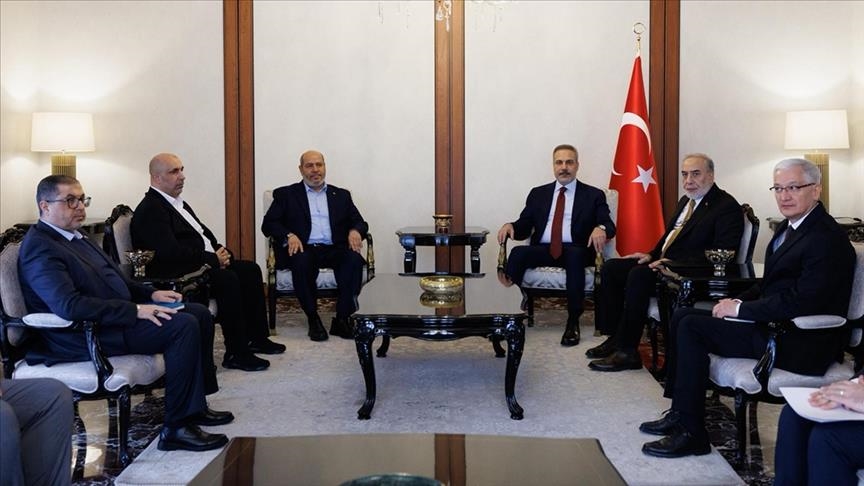

Under the shadow of these realities, Turkish Foreign Minister Hakan Fidan’s line over the last weeks was unusually clear: Turkey opposes any military intervention against Iran and insists that Iran’s internal problems should not be “solved” through external force. This position is often read as a moral preference for non-intervention. It is that—but it is also hard-headed realism. Ankara’s calculus is shaped by four overlapping concerns. First, a strike-and-escalate spiral risks producing another displacement shock, with Turkey once again absorbing the strategic and social costs of a regional conflagration. Second, a major Iran crisis amplifies volatility in Iraq and Syria, where Turkey’s security priorities are already tied to cross-border dynamics. Third, intervention scenarios can further empower Israel’s regional freedom of action in ways that narrow Turkey’s diplomatic room, especially at a time when Gaza and broader regional alignments are already contentious. Fourth—and most sensitive—an Iranian internal crisis can activate Kurdish dynamics in Iran in ways that spill across borders, complicating Turkey’s own domestic stabilization efforts.

This is where Syria’s recent turn becomes highly relevant. With Damascus pushing east of the Euphrates and rapidly consolidating territory previously under SDF control, the old equilibrium—where the SDF functioned as a durable, US-backed territorial actor—has eroded. The ceasefire and the integration talks now being pressed onto the SDF underline the same point: the SDF is negotiating from a position of reduced leverage, while the United States is signalling that it is no longer willing to underwrite Kurdish autonomy as a strategic project. For Tehran, this matters because the “northern arc” of pressure politics—through Iraq, Syria, and the Kurdish file—looks different when Kurdish armed structures are being squeezed and when Washington is demonstrably less committed to sustaining them. For Ankara, it matters because it removes (at least partially) one of the persistent irritants in the US–Turkey security relationship and reduces the space for non-state Kurdish armed actors to convert Syrian depth into regional bargaining power.

It is precisely at this juncture that the “Iran file” should be read as a high-density, multi-actor arena in which divergent preferences collide, and even limited shocks can generate disproportionate second- and third-order spillovers across the region’s already fragile security, political, and economic equilibria.

The Gulf’s Calculation: Pressure or Control?

From the Gulf perspective—particularly in Saudi Arabia—Iran is viewed through a dual lens of rivalry and vulnerability. Riyadh would clearly prefer an Iran that is contained: its regional influence curtailed, its coercive leverage reduced, and its proxy networks restrained. Yet a scenario of outright Iranian collapse is not, for the Kingdom, an inherently desirable outcome—neither for energy markets nor for regional security. The predictability and investor confidence required by Vision 2030 sit uneasily with the prospect of a major Iran-driven confrontation that would inject volatility into oil prices, shipping routes, insurance costs, and broader risk perceptions across the Gulf. Moreover, Saudi Arabia and other Gulf monarchies are wary that a dramatic rupture in Iran could disproportionately empower Israel in the regional balance, while simultaneously making the domestic defence of normalisation—particularly under the broader logic associated with the Abraham Accords—politically costly, if not untenable, at home.

By contrast, Qatar and the United Arab Emirates tend to operate with a more flexible approach that keeps economic and diplomatic channels with Tehran open. For Qatar, this posture is anchored in both structural and strategic considerations: the shared North Field/South Pars gas reservoir creates an enduring interdependence, while Doha’s mediation identity benefits less from a clean break than from a managed level of tension in which it can remain a convening actor. The UAE—and, to an extent, Bahrain—appear to prefer maintaining room for manoeuvre: preserving the gains of the Abraham Accords without being irreversibly locked into them should regional dynamics shift. This leaves them the option of slowing normalisation, recalibrating symbolism, or taking limited tactical steps back if escalation intensifies, without fully abandoning their broader strategic trajectory.

Taken together, the emerging Gulf consensus is not one of sudden regime change or a large-scale war, but rather an equilibrium of “maximum control”: an Iran kept under sustained pressure—costly enough to deter adventurism, yet contained enough to avoid systemic collapse—while commercial and diplomatic channels remain sufficiently intact to reduce escalation risks and preserve regional economic stability.

Russia and China: Energy, Balancing, and Competition with the United States

In the broader geopolitical landscape, Russia approaches the Iran file primarily through two interconnected prisms: energy market dynamics and Moscow’s room for manoeuvre in the Middle East under conditions of heightened confrontation with the West. Since the outbreak of the war in Ukraine and the tightening of Western sanctions, Russia has sought additional strategic breathing space by deepening defence and security cooperation with Iran, while simultaneously attempting to translate uncertainty in oil and gas markets into price dynamics that cushion its fiscal position. From Moscow’s perspective, a scenario of regime changes in Iran—or prolonged, uncontrolled chaos—would be inherently destabilising. It would risk unsettling the balance across the Caspian basin, disrupting Russia’s operational calculations in Syria, and generating new volatility in the Caucasus, a theatre where Russia remains highly sensitive to shifts in influence and transport corridors. For these reasons, the Kremlin has little interest in an Iranian collapse that could unleash unpredictable second-order effects across Russia’s southern periphery.

At the same time, Moscow is not necessarily opposed to tension per se—provided it remains manageable. A controlled level of escalation can support higher oil prices, indirectly bolstering Russia’s budget at a time of sanctions-induced strain. It also allows Russia to present itself as one of the political architects of a “non-Western axis,” reinforcing its broader narrative of multipolar resistance and strategic autonomy. Yet this is a balancing act, not an ideological blank cheque for Tehran. Russia does not want the United States to conduct a major military build-up in the region under the banner of “containing Iran,” as this could constrain Moscow’s freedom of action and complicate its bargaining position in Syria and the Eastern Mediterranean. Conversely, Russia is equally unlikely to endorse an Iran that enjoys complete strategic latitude, since an unconstrained Tehran could generate crises that undermine Russia’s own regional posture or force Moscow into costly commitments. In practice, Russia’s preferred equilibrium is one in which it can preserve its Syrian presence and maintain its Eastern Mediterranean leverage—benefiting from a degree of regional friction, but avoiding a systemic rupture that would eliminate predictability.

China’s approach, by contrast, is driven more consistently by energy security and the logic of global competition with the United States. Beijing’s long-term energy and infrastructure arrangements with Iran matter not only as part of its diversification strategy for oil supplies but also as a component of the Belt and Road Initiative’s wider connectivity ambitions. From this standpoint, China has little appetite for a major confrontation around the Strait of Hormuz or its surrounding maritime corridors. A large-scale conflict would not only risk sharp spikes in oil prices, but also disrupt supply chains, undermine global growth, and damage China’s external markets—costs that Beijing has strong incentives to avoid.

Yet China’s calculus is not simply about stability. In strategic terms, a United States that is compelled to invest more military and political capital in the Middle East can be seen in Beijing as a structural opportunity: it potentially widens China’s manoeuvring space in the Asia–Pacific by stretching American attention, resources, and strategic bandwidth. This produces a distinctive preference structure. Beijing’s ideal outcome is neither an Iranian collapse nor a rapid American disengagement that would allow Washington to redeploy decisively elsewhere. Rather, it is an intermediate formula: Iran is not eliminated from the regional equation, energy flows are not seriously interrupted, and the risk of systemic war is contained—while the United States remains sufficiently engaged in the Middle East to limit its freedom to pivot fully toward China. In that sense, China’s approach is best described as a managed-stability strategy that seeks to prevent catastrophic disruption without removing the structural constraints that keep Washington strategically overextended.

U.S. Uncertainty and Israel’s Fear of Strategic Isolation

On the Washington front, the return of a Trump administration to the White House has injected a qualitatively different kind of uncertainty into the Iran file. Unlike foreign-policy approaches that are anchored in relatively stable institutional processes and strategic signalling, Trump-era decision-making has often been shaped more by domestic political incentives, personal calculations, and rapid shifts in tone and emphasis. Under this logic, it is difficult to speak of a coherent, long-term roadmap toward Iran. “Trump America” can oscillate sharply between intensifying pressure on Tehran and signalling an accelerated desire to reduce regional exposure; it can offer allies emphatic assurances one day and recalibrate—or downgrade—those commitments the next. The result is not merely ambiguity but a structurally volatile signalling environment, where adversaries and partners alike struggle to infer credible intentions over time.

For Israel, this uncertainty translates into a serious strategic constraint. Tel Aviv’s posture toward Iran is frequently framed in maximalist terms, and Israeli leaders may appear more willing than ever to contemplate an expansive confrontation designed to degrade Iranian capabilities and deterrence. Yet the feasibility of sustaining such a high-cost campaign is inseparable from the United States. Without U.S. military capacity, political legitimacy, and diplomatic cover—both to sustain operations and to manage the international fallout—Israel’s ability to wage a prolonged, large-scale war is sharply limited. In other words, Israeli assertiveness is underwritten by a broader American umbrella: access to critical munitions and intelligence cooperation, extended deterrence, and the diplomatic shielding required to weather international pressure.

This is precisely why Washington’s unpredictable trajectory is unsettling for Tel Aviv. The harder Israel leans into coercive signalling, the more it depends on the credibility of U.S. backing to deter escalation and to absorb strategic risk. But if U.S. commitments are perceived as contingent, reversible, or domestically driven, Israel confronts a dilemma: it may want to push the confrontation envelope, yet it cannot be confident that it will not be left carrying the costs alone. Under conditions of sustained American volatility, therefore, Israel’s room for unilateral escalation is narrower than its rhetoric suggests—because the decisive question is not merely whether Israel is willing to act, but whether it believes the United States will remain firmly and predictably engaged when the costs inevitably rise.

High Uncertainty—and the Limits of Ankara’s Room for Manoeuvre

At this stage, Turkey appears to have adopted one of the most rational positions available on the Iran file: opposing military intervention, seeking to minimise displacement risks, preventing a scenario in which Israel’s regional freedom of action becomes disproportionate, and containing the ways Iran’s internal fragilities could spill into—and polarise—Turkey’s domestic politics. In principle, this is a prudent posture grounded in regional realities rather than ideological reflex. Yet even the “right” position does not dissolve the underlying volatility. The Iran-centred equation is now crowded with actors pursuing contradictory objectives through flexible, transactional alignments; in such a setting, a tactical move in one arena can trigger a strategic rupture elsewhere. In other words, Turkey may be reading the landscape correctly, but that does not imply that 2026 will be less risky. If anything, it suggests a year in which the “Iran file” will feature more frequently both in crises and at negotiating tables—requiring Ankara to calibrate its balancing strategy with greater precision, speed, and political discipline.

It is also worth adding a hard constraint often underplayed in Ankara’s domestic debate. Turkey has, by and large, played this hand intelligently so far—maximising autonomy where it can and hedging against worst-case outcomes. But if Washington were to decide that “change” in Iran is a strategic priority—whether through intensified coercion, escalation management that collapses into confrontation, or a broader regional reconfiguration—Turkey’s ability to stand in the way would be limited. The United States retains meaningful leverage in Turkey’s security environment, not least through the Kurdish file and wider regional bargaining dynamics. Any major American push on Iran would therefore come with expectations and trade-offs: Ankara might secure tactical gains on one front, but it should also anticipate that these gains would carry political and strategic costs elsewhere. In short, Turkey can manage risk and shape margins—but it cannot fully insulate itself from the consequences of a decisive U.S. turn on Iran, and it will likely be asked to “pay” for whatever accommodation or latitude it receives along the way.